Understanding Dental Benefits

Why doesn’t my insurance plan cover the treatment the Doctor is recommending?

Anna Nierenberg, Director of First Impressions March 2021

The first thing to understand about dental insurance is that it isn’t insurance at all. Insurance originated as and is by definition, a pooling of funds to pay for a rare, but catastrophic event. Fire insurance is an excellent example. Originally, medical insurance was also designed this way. Payment for routine office visits, basic medications, and low deductibles are a relatively recent modification in medical policies to create additional employee benefits that are not true insurance but “tax-free” benefits.

Restrictions and Limitations

Unlike events like cancer or your house burning down, dental disease is neither rare nor catastrophic. Therefore, dental insurance isn’t insurance at all but really a method for employees to receive “tax-free benefits.” Rather than insurance, it is more accurate to refer to them as dental benefit plans. When originally introduced in the 1970’s, these plans were very simply designed and employees could go to any dentist. To keep premiums reasonable, total benefits in any one year were limited to $1,000.00. Fifty years later, most benefit plans still have this same maximum limit. Premiums, of course, have gone up because the costs for administering these plans (employee wages, cost of living, etc.) have increased. To attempt to keep premium costs down for employers and to continue to serve shareholders with profits, health care companies have significantly modified the original plan structures. This is the reason there are a variety of plans available such as dental capitation plans, dental HMOs, Dental preferred provider organizations (PPO’s), dental referral organizations (DFO’s), etc. It is just as hard for dental offices to understand the details of all these different plans as it is for patients! The bottom line however in all of these alphabet soup plans, is RESTRICTIONS AND LIMITATIONS. The most common restriction is whom you are encouraged to choose for your dentist. Actually, it’s against the law in most states to restrict you from seeing any health care provider you want but, should you go out of the “network” your benefit may be reduced from 1`0-30%. In all of the restrictive plans, there is not only a contract between your employer and the insurance company; the plan dentist has signed a contract as well. The benefit for the dentist is that his/her name appears on a list and you are encouraged to choose this practitioner. What the dentist has to agree to in order to gain this “preferred provider status” varies from contract to contract.

Limitations can take many forms. The most common is to exclude certain services altogether, usually the better treatments or the newer, superior services now available because of advancements in science and technology. Another limitation is the “LEAT” clause, which stands for least expensive alternative treatment. Essentially, this clause allows the insurance company to choose to pay a lesser benefit for the cheapest material or treatment that they consider is adequate for you. This is a very broad power and it is a clerical person sitting at a computer that usually makes this determination. Even when referred to a dental consultant the judgement is still made by a company employee who has not personally examined the condition being treated. Keep in mind, an x-ray is only a single diagnostic tool and is not a substitute for a clinical examination.

What all this means is that the changes in dental benefits plans over the last decade have changed the benefits to you, the employee. Whereas benefits were once determined based on need, they are no longer based on need but specific contract terms negotiated between an employer and a health-care insurance company. In plans that direct you to specific dentists, there is also a contract containing specific agreements between the insurance company and the dentist.

*Cosmetic Dentistry and Photography: James W. W. McCreight, DDS.*

Impact on You

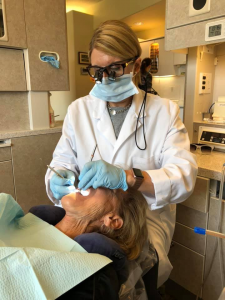

Wendy McCrieght practicing the “WIDIOM” principle on her mother*

How does this impact you and your care in this office? We will make no contract agreements with anyone regarding something as important as your dental health, with anyone but You. We will take whatever time is necessary to perform a thorough examination along with any needed diagnostic procedures in order to make an accurate diagnosis. We will take the necessary time to help you understand your current level of dental health and be guided by the “WIDIOM” principal when recommending treatment– “would I do it on myself.” WServices | Dentist Steamboat Springs, COe will help you understand your problem, your treatment choices, and the consequences of those choices, so that you may choose what is best for you. Because our obligation is only to you, once you choose your care, there will be no compromises in rendering it.

Even though we don’t contract with any plans, you can still receive care in our office and receive benefits according to the terms of your employer’s contract. We will help you understand your plan and its limitations as best we can, if you provide it to us. We will provide you with the necessary documentation to attach to your claim form so you can receive whatever reimbursement you are entitled to. Further, we will be available as a resource if more information is needed. We are you dental health advocates. However, we are powerless to influence plan benefits negotiated between your employer and the insurance company. Only you, through your employer or the benefits manager at your company can do this.

Summary

The common theme today, when dental benefit plans deny or reduce benefits, is to imply that the care is not needed or the fee charged was too high. We feel you are the best judge of your need, not a clerical personal at an insurance company. Our response to the insurance company regarding fees is that their benefits are too low. Once again, you are the best judge whether our fees match our quality.

Finally, because most plans have not increased their yearly maximums and continue to reduce covered benefits, many employers are eliminating the middleman altogether and instituting various self-administered plans such as direct reimbursement. We can provide you with information and agent names to pass on to your employer if you are interested.

We hope this explanation of a seemingly complicated and continually changing topic has helped. Please feel free to ask questions about your care at any time.

We hope you found value in the information within our article. For more tips, information, and fun topics please follow us on Facebook/ Instagram/ or Twitter.

By: Anna Nierenberg- Director of First Impressions